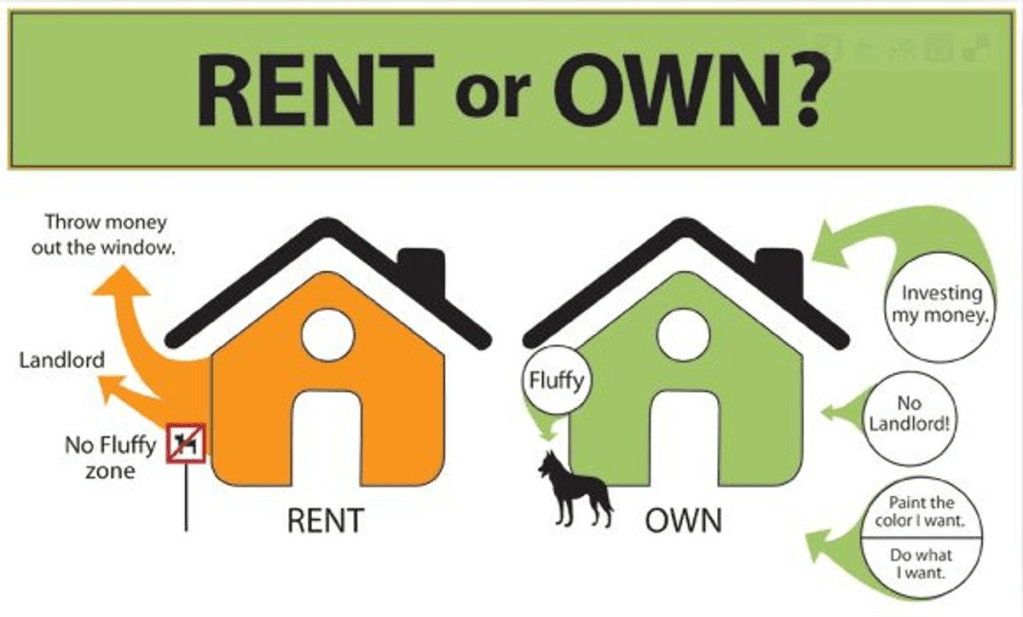

The age-old question of whether to rent or buy a property is one many individuals and families grapple with. While renting offers flexibility and fewer responsibilities for maintenance, buying a property presents a compelling array of benefits that contribute to long-term financial stability and personal well-being. One of the most significant advantages of homeownership is building equity. Each mortgage payment contributes to your ownership stake in the property, effectively serving as a forced savings account. As your equity grows, especially in a thriving market like Secaucus, New Jersey, it becomes a valuable asset that can be leveraged for future financial goals, such as funding education, starting a business, or even purchasing another property.

Beyond the financial gains, owning a home provides a sense of stability, permanence, and freedom that renting simply cannot match. Homeowners have the liberty to personalize their living space, undertake renovations, and truly make a house their own without needing landlord approval. This ability to customize and invest in your surroundings creates a stronger sense of attachment and community. Furthermore, fixed-rate mortgages offer predictable monthly housing costs, providing a hedge against rising rental prices. While buying comes with responsibilities, the long-term benefits of equity growth, potential tax deductions, and the intangible value of having a place to truly call your own often make it a superior choice for those looking to establish roots in a community like Secaucus.

You must be logged in to post a comment.